Killam Apartment REIT Announces Continued Strong Financial Results in Q1-2022 and $116.1 Million in Acquisitions

Killam Apartment REIT (TSX: KMP.UN) ("Killam" or the "REIT") today reported its results for the three months ended March 31, 2022.

"Killam's first quarter earnings growth and operating performance were strong," noted Philip Fraser, President and CEO. "The same property revenue growth of 5.1% in Q1-2022 reflects the strong demand for housing across all our markets. Despite a colder winter season and higher heating costs this quarter, Killam achieved 3.1% same property net operating income growth to start the year."1

"Our development program will deliver much anticipated growth to our portfolio in 2022 and 2023," stated Mr. Fraser. "The Latitude and Kay are now both opened and approximately 60% leased, and we are pleased with the pre-leasing activity at the Luma, which is opening in June."

"Year-to-date, we have grown our portfolio by $60.5 million in acquisitions in Halifax, Waterloo, Guelph and Victoria, complementing our existing portfolio and growing our presence in our key markets" stated Mr. Fraser. "As well, we expanded our BC presence and expect to close our first acquisition in Courtenay, BC, later this month with 150 newly built units, for $55.6 million. Geographical diversification continues to be a driver of our business strategy, aiding to accretively growing earnings for our unitholders."

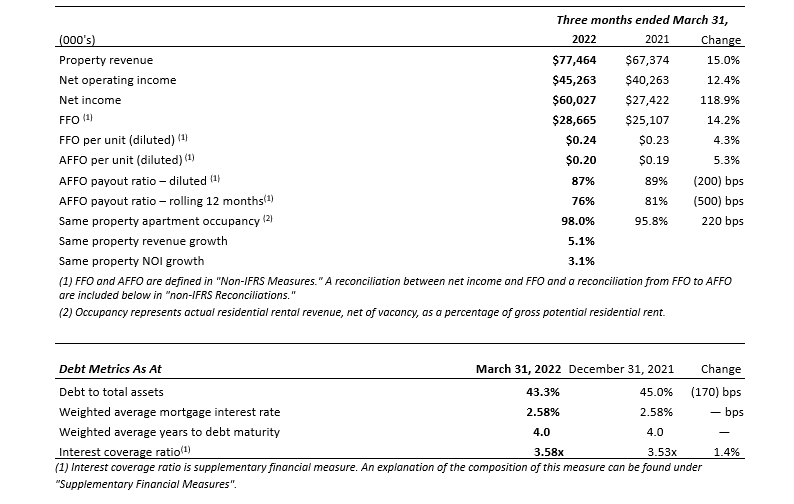

Q1-2022 Financial & Operating Highlights

- Reported net income of $60.0 million, an increase of $32.6 million compared to $27.4 million in Q1-2021, primarily attributable to fair value gains on investment properties driven by rent growth and strong occupancy, growth through acquisitions, completed developments, and increased earnings from the existing portfolio.

- Generated net operating income (NOI) of $45.3 million, a 12.4% increase from $40.3 million in Q1-2021.

- Earned funds from operations (FFO) per unit (diluted) of $0.24, an 4.3% increase from $0.23 in Q1-2021.2

- Increased adjusted funds from operations (AFFO) per unit (diluted) by 5.3% to $0.20, from $0.19 in Q1-2021, and reduced the first quarter AFFO payout ratio (diluted) 200 basis points (bps) to 87%, from 89% in Q1-2021.2

- Achieved a 5.1% increase in revenue for the same property portfolio.

- Generated same property NOI growth of 3.1% over Q1-2021.

- Reduced debt to total assets by 170 bps and increased capital flexibility with the closing of a $98.1 million public offering on February 4, 2022.

Summary of Q1-2022 Results and Operations

Earned Net Income of $60.0 Million

Killam earned net income of $60.0 million in Q1-2022, compared to $27.4 million in Q1-2021. The increase in net income is primarily attributable to fair value gains on investment properties, growth through acquisitions, completed developments, and increased earnings from the existing portfolio.

Delivered 4.3% FFO per Unit Growth

Killam generated FFO per unit of $0.24 in Q1-2022, a 4.3% increase from $0.23 per unit in Q1-2021. AFFO per unit increased 5.3% to $0.20, compared to $0.19 in Q1-2021. The growth in FFO and AFFO was primarily attributable to increased NOI from Killam's same property portfolio and incremental contributions from over $400 million in recent acquisitions. This growth was partially offset by a 9.4% increase in the weighted average number of units outstanding.

Revenue Growth Supports Same Property NOI Growth of 3.1%

Despite inflationary pressures, Killam achieved 3.1% growth in same property consolidated NOI during the quarter. This improvement was driven by 5.1% growth in revenue, partially offset by an 8.2% increase in operating expenses. A 220 bps increase in same property apartment occupancy coupled with a 3.3% increase in apartment rental rates drove overall revenue growth. Operating expenses increased largely due to higher utility and fuel costs as a result of increases in natural gas pricing across all of Killam's core markets, as well as increased consumption due to a colder winter. A 5.5% increase in property taxes also contributed to higher-than-normal expense growth.

Continued Advancement of Development Pipeline

Killam continues to advance its development pipeline, with four developments underway totaling 477 units (393 units representing Killam's ownership interest) for an expected total development cost of $241.1 million ($195.3 million for Killam's ownership interest). During the first quarter, Killam invested $20.5 million in its active development projects, the majority of which was funded through construction financing. Killam's joint development project, Latitude, a 208-unit building located in Ottawa, Ontario, was completed during the first quarter. This development reached substantial completion in March 2022 and is currently 61% leased. Overall, this asset generated $8.9 million in fair value gains since the project began in 2018 and is expected to contribute $2.0 million in NOI annually, once stabilized.

Strong Rent Growth Supports $28 Million in Fair Value Gains

Killam recorded $28.0 million in fair value gains related to its investment properties in Q1-2022, supported by robust NOI growth driven by strong apartment fundamentals. Killam's weighted average cap-rate for its apartment portfolio as at March 31, 2022, was 4.41%, consistent with December 31, 2021.

Rising Interest Rates

Killam benefited from lower interest rates on mortgages refinanced in Q1-2022; however, this trend is not expected to continue throughout the remainder of the year, as interest rates continue to rise. During Q1-2022, Killam refinanced $36.2 million of maturing mortgages with $58.8 million of new debt, the majority of which was for 10-year terms at a weighted average interest rate of 3.08%, slightly lower than 3.11% for the maturing debt.

ESG Update

During Q1-2022, Killam completed its third-party verified energy consumption and greenhouse gas (GHG) review. Killam achieved a 5.6% reduction in like-for-like energy consumption and an 8.6% reduction in GHG intensity (tCO2e per square foot) in 2021, compared to 2020. Killam now has 12 photovoltaic (PV) solar arrays producing power, with an expected 1,300 MWh of annual energy production. PV solar arrays, along with geothermal heating and cooling systems at Killam’s new developments, illustrate Killam’s on-going commitment to lower its carbon footprint.

Killam has published its 2021 ESG report, which can be accessed on its website at https://killamreit.com/esg. The report summarizes Killam’s 2021 achievements, describes Killam’s commitment to creating and maintaining sustainable communities, and details its progress and future plans to achieve its long-term targets.

2022 Acquisitions

Killam invested $60.5 million in acquisitions year to date, which include:

1477 & 1479 Carlton Street

On February 16, 2022, Killam completed the acquisition of a four-unit apartment property in Halifax, NS, for $3.5 million. This building is adjacent to other Killam properties on Spring Garden Road and complete the lot consolidation for the planned future development.

510-516 Quiet Place

On March 7, 2022, Killam completed the acquisition of a 24-unit apartment property in Waterloo, ON, for $7.9 million. The four, six-unit buildings are located on a 1.2-acre property which has future development potential, with zoning for approximately 300 units.

150 Wissler Road

On March 17, 2022, Killam completed the acquisition of a 5,000 square foot retail plaza containing 0.75 acre located adjacent to Northfield Gardens property in Waterloo, ON for $3.9 million. This property, combined with surplus land already owned, will provide an opportunity to build up to 150 residential units in the future.

Craigflower House

On March 31, 2022, Killam acquired a 49-unit apartment property in Esquimalt, BC, for $14.0 million. This acquisition is Killam's third in the Greater Victoria Area.

1358 Hollis Street, Halifax, NS

On April 6, 2022, Killam acquired 1358 Hollis Street, a 27-unit building located adjacent to other Killam properties in downtown Halifax, for $6.2 million ($230,000 per unit). This property has a mix of bachelor, one and two bedroom units at an average monthly rent of $1,040 and is 100% leased.

671 Woolwich St, Guelph, ON

On April 29, 2022, Killam purchased 671 and 665 Woolwich Street for $25.0 million ($250,000/unit and $4.0 million for land) in Guelph, Ontario. 671 Woolwich Street is a 12-storey, 84-unit concrete building that contains a mix of one, two and three bedroom units. The average monthly rent is $1,218 and is currently 96% leased. 665 Woolwich is development land adjacent to the apartment building zoned for potential 10 storeys and 100 to 150-unit development.

Subsequent to quarter end, Killam committed to acquire two properties in Courtenay, BC, for a total of $55.6 million. The Shores (located at 1849 & 1876 Riverside Lane) contains two, four-storey wood-framed buildings with 94 units. This new property has a mix of one, two and three bedroom units and is fully leased, with an average monthly rent of $1,641. The Residences (located at 621 Crown Island Blvd) contains one, four-storey wood-framed building with 56 units. This recently completed building has a mix of one and two bedroom units and is fully leased, with an average monthly rent of $1,608.

These acquisitions will increase Killam's portfolio on Vancouver Island to 516 units. Courtenay is a growing city in the Comox Valley with a diverse economic base, including Canada's only west coast Canadian Air Force Base.

Financial Statements

Killam’s condensed consolidated interim Financial Statements and Management’s Discussion and Analysis for the three months ended March 31, 2022, are posted under Financial Reports in the Investor Relations section of Killam’s website at www.killamreit.com and are available on SEDAR at www.sedar.com. Readers are directed to these documents for financial details and a discussion of Killam’s results.

Results Conference Call

Management will host a webcast and conference call to discuss these results and current business initiatives on Thursday, May 5, 2022, at 9:00 AM eastern time. The webcast will be accessible on Killam’s website at the following link: http://www.killamreit.com/investor-relations/events-and-presentations. A replay will be available for 7 days after the webcast at the same link.

The dial-in numbers for the conference call are as follows:

North America (toll free): 1-888-664-6392

Overseas or local (Toronto): 1-416-764-8659

Profile

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $4.7 billion portfolio of apartments and manufactured home communities. Killam’s strategy to enhance value and profitability focuses on three priorities: 1) increasing earnings from existing operations, 2) expanding the portfolio and diversifying geographically through accretive acquisitions, with an emphasis on newer properties, and 3) developing high-quality properties in its core markets.

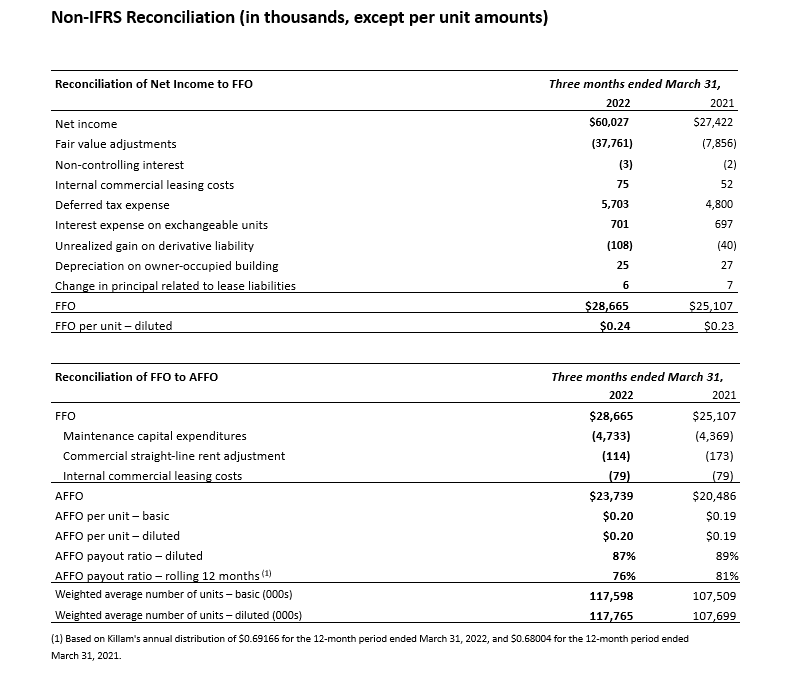

Non-International Financial Reporting Standards (IFRS) Measures

Management believes the following non-IFRS financial measures, ratios and supplementary information are relevant measures of the ability of Killam to earn revenue and to evaluate Killam's financial performance. Non-IFRS measures should not be construed as alternatives to net income or cash flow from operating activities determined in accordance with IFRS, as indicators of Killam's performance, or sustainability of Killam's distributions. These measures do not have standardized meanings under IFRS and, therefore, may not be comparable to similarly titled measures presented by other publicly traded organizations.

- Funds from operations (FFO) is a non-IFRS financial measure of operating performance widely used by the Canadian real estate industry based on the definition set forth by REALPAC. FFO, and applicable per unit amounts, are calculated by Killam as net income adjusted for fair value gains (losses), interest expense related to exchangeable units, gains (losses) on disposition, deferred tax expense (recovery), unrealized gains (losses) on derivative liability, internal commercial leasing costs, depreciation on an owner-occupied building, interest expense related to lease liabilities, and non-controlling interest. FFO is calculated in accordance with the REALPAC definition. A reconciliation between net income and FFO is included below.

- Adjusted funds from operations (AFFO) is a non-IFRS financial measure of operating performance widely used by the Canadian real estate industry based on the definition set forth by REALPAC. AFFO, and applicable per unit amounts and payout ratios, are calculated by Killam as FFO less an allowance for maintenance capital expenditures ("capex") (a three-year rolling historical average capital investment to maintain and sustain Killam's properties), commercial leasing costs and straight-line commercial rents. AFFO is calculated in accordance with the REALPAC definition. Management considers AFFO an earnings metric. A reconciliation from FFO to AFFO is included below.

- Per unit calculations are calculated using the applicable non-IFRS financial measures noted above, i.e. FFO, AFFO and/or ACFO, divided by the basic or diluted number of units outstanding at the end of the relevant period.

Supplementary Financial Measures

- Same property NOI is a supplementary financial measure defined as NOI for stabilized properties that Killam has owned for equivalent periods in 2022 and 2021. Same property results represent 90.5% of the fair value of Killam's investment property portfolio as at March 31, 2022. Excluded from same property results in 2022 are acquisitions, dispositions and developments completed in 2021 and 2022, and non-stabilized commercial properties linked to development projects.

- Interest coverage is calculated by dividing adjusted earnings before interest, tax, depreciation and amortization (adjusted EBITDA) by mortgage, loan and construction loan interest and interest on credit facilities. Normalized adjusted EBITDA is calculated by Killam as adjusted EBITDA that has been normalized for a full year of stabilized earnings from recently completed acquisitions and developments, on a forward-looking basis.

For information, please contact:

Nancy Alexander, CPA, CA

Vice President, Investor Relations & Sustainability

nalexander@killamREIT.com

(902) 442-0374

Note: The Toronto Stock Exchange has neither approved nor disapproved of the information contained herein. Certain statements in this press release may constitute forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "commit", "estimate”, "potential", "continue", "remain", "forecast", "opportunity", "future" or the negative of these terms or other comparable terminology, and by discussions of strategies that involve risks and uncertainties. Such forward-looking statements may include, among other things, statements regarding: market fundamentals and regional economies in Killam’s markets; acquisition capacity; the completion, costs, capacity, total investment and timing of development projects and acquisitions; annual FFO and certain properties' contributions thereto; demand; reducing Killam's environmental impact; the ability of Killam's development program to deliver anticipated portfolio growth; geographical diversification of our portfolio and its impact on our business strategy; unitholder earnings; development pipeline; Killam's commitment to sustainability and ESG and related targets; Killam's priorities; and interest rates.

Readers should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated or implied, or those suggested by any forward-looking statements, including: the effects, duration and government responses to the COVID-19 pandemic and the effectiveness of measures intended to mitigate the impact of COVID-19 and any variants thereof, including vaccines; competition; national and regional economic conditions and the availability of capital to fund further investments in Killam's business. For more exhaustive information on these risks and uncertainties, readers should refer to Killam’s most recently filed annual information form, as well as Killam's most recently filed MD&A, each of which are available at www.sedar.com. Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements contained in this press release.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events may not occur. Although Management believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that future results, levels of activity, performance or achievements will occur as anticipated. Further, a forward-looking statement speaks only as of the date on which such statement is made and should not be relied upon as of any other date. While Killam anticipates that subsequent events and developments may cause Killam's views to change, Killam does not intend to update or revise any forward-looking statement, whether as a result of new information, future events, circumstances, or such other factors that affect this information, except as required by law. The forward-looking statements in this press release are provided for the limited purpose of enabling current and potential investors to evaluate an investment in Killam. Readers are cautioned that such statements may not be appropriate and should not be used for any other purpose. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement.