Killam Apartment REIT Announces Q3-2021 Operating Performance and Financial Results and $118 Million in Acquisitions

Killam Apartment REIT (TSX: KMP.UN) ("Killam" or the "REIT") today reported its results for the three and nine months ended September 30, 2021.

"Killam's third quarter earnings growth momentum and operating performance were very strong," noted Philip Fraser, President and CEO. "The same property net operating income ("NOI") growth of 7.4% in Q3-2021 is a reflection of the resilient demand for apartments, the rebound of our seasonal manufactured home communities and strong leasing in our commercial segment. Given these trends, Killam expects same property NOI growth to exceed 4.0% for 2021."

"Subsequent to quarter-end, we invested $118.3 million in four new properties totalling 482 units in Charlottetown, Moncton and two in Edmonton" stated Mr. Fraser. "These are new, high-quality assets that complement our existing portfolio. We have had robust growth year-to-date and have added 1,601 apartment units from our acquisitions and development programs."

"With strong organic results and active acquisition and development pipelines, we continue to execute on our growth strategy to expand the portfolio and diversify geographically across Canada."

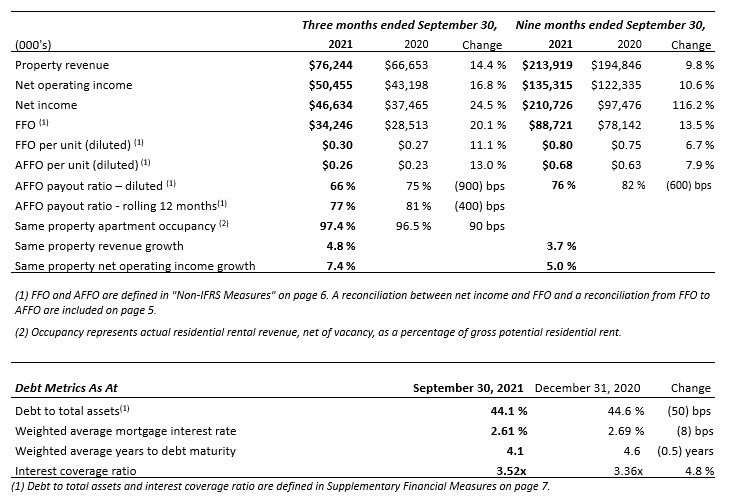

Q3-2021 Financial & Operating Highlights

- Reported net income of $46.6 million, an increase of $9.1 million compared to $37.5 million in Q3-2020, primarily attributable to growth through acquisitions, completed developments, and increased earnings from the existing portfolio, as well as fair value gains on investment properties driven by cap-rate compression.

- Generated NOI of $50.5 million, a 16.8% increase from $43.2 million in Q3-2020.

- Earned funds from operations ("FFO") per unit (diluted) of $0.30, an 11.1% increase from $0.27 in Q3-2020.Increased adjusted funds from operations ("AFFO") per unit (diluted) by 13.0% to $0.26, from $0.23 in Q3-2020, and reduced the third quarter AFFO payout ratio (diluted) 900 basis points ("bps") to 66%, from 75% in Q3-2020.

- Achieved a 4.8% increase in revenue for the same property portfolio.

- Generated same property NOI growth of 7.4% over Q3-2020 and improved the NOI margin by 160 bps to 66.1%.

Summary of Q3-2021 Results and Operations

Achieved Net Income of $46.6 Million

Killam earned net income of $46.6 million in Q3-2021, compared to $37.5 million in Q3-2020. The increase in net income is primarily attributable to growth through acquisitions, completed developments, and increased earnings from the existing portfolio as well as fair value gains on investment properties, driven by revenue growth and cap-rate compression.

Delivered Value Through FFO per Unit Growth of 11.1% and AFFO per Unit Growth of 13.0%

Killam generated FFO per unit of $0.30 in Q3-2021, 11.1% higher than $0.27 per unit generated in Q3-2020. AFFO per unit increased 13.0% in Q3-2021 to $0.26, compared to $0.23 in Q3-2020. FFO and AFFO growth were primarily attributable to increased NOI from strong same property performance and incremental contributions from recent acquisitions and completed developments. This growth was partially offset by an 8.1% increase in the weighted average number of units outstanding.

Strong Same Property NOI Growth of 7.4%

Killam achieved 7.4% growth in same property consolidated NOI and a 160 bps improvement in its operating margin during the quarter. This improvement was driven by 4.8% growth in same property revenue, and only a modest 0.2% increase in operating expenses. A 3.4% increase in apartment rental rates and a 90 bps increase in occupancy drove overall revenue growth. Operating expenses remained relatively flat quarter-over-quarter as a result of operating and energy efficiencies, as well as successful property tax appeals.

Killam's same property apartment NOI increased 5.8% during Q3-2021. MHC same property NOI, which accounts for 6.9% of total NOI, generated 12.8% growth from the rebound of seasonal occupancy as many COVID-19 related restrictions were lifted. Commercial same property NOI, which accounts for 5.1% of total NOI, generated 27.9% growth in the quarter as a result of higher occupancy and reduced rent abatements related to COVID-19.

Enhanced Top-line Performance from Unit Turns and Repositionings

Demand remains strong for units on turnover with Killam achieving 7.7% rental rate growth on unit turns and repositionings during the quarter. Overall, same property apartment revenue growth during the quarter was up 4.1%.

Substantial Development Activity Underway and Strong Contributions from Recently Completed Developments

Killam continues to advance its development pipeline with five active developments underway, totalling 685 units (497 units representing Killam's percentage ownership) for an expected total development cost of $328.1 million ($236.5 million for Killam's ownership interest). Year-to-date, Killam has invested $51.8 million in active development projects, the majority of which was funded through construction loans.

Killam's three recently completed developments totalling 349 units, being Nolan Hill, Shorefront and 10 Harley, contributed $0.7 million in FFO growth during Q3-2021. These developments are fully leased and are expected to contribute $3.0 million in FFO on an annualized basis.

Cap-rate Compression and Strong Rent Growth Support $26 Million in Fair Value Gains

Killam recorded $25.8 million in fair value gains related to its investment properties in Q3-2021, supported by cap-rate compression in New Brunswick and its Ontario MHC portfolio, as well as robust NOI growth driven by strong apartment fundamentals. Killam's weighted average cap-rate for its apartment portfolio as at September 30, 2021, was 4.42%, a 25 bps reduction from December 31, 2020.

Lower Interest Rates Contribute to Earnings Growth

Killam benefited from lower interest rates on mortgage refinancings completed during the quarter. Killam refinanced $27.3 million of maturing debt with $37.0 million of new debt at a weighted average interest rate of 1.98%, 43 bps lower than the weighted average interest rate of the maturing debt.

COVID-19 Impact on Operations

Since the onset of the global pandemic in March 2020, Killam has focused on ensuring the continued health and safety of its employees, tenants, stakeholders and communities. Killam's rent collection remains strong, with rent collection rates above 99%. To date, the pandemic has not resulted in any material change to Killam’s operations or strategy. Details on Killam’s financial impact from COVID-19 are included in Killam’s 2020 Management Discussion and Analysis, available on SEDAR at www.sedar.com.

Q4-2021 Acquisitions

140 Dale Drive, Charlottetown, PE

On October 6, 2021, Killam purchased 140 Dale Drive, a new 61-unit, four-storey, wood-frame apartment building in Charlottetown, PE for $15.3 million ($251,000 per unit). This building contains 30 affordable rental units as part of a Canada Mortgage and Housing Corporation National Housing Strategy program that supports rental housing construction projects to encourage a stable supply of rental housing for middle-class families across Canada. This program provides a lower interest rate on the property's debt financing, as well as an operating grant and a reduction on the municipal portion of the building property taxes.

The average monthly rent for the affordable units is $971 ($1.14 per square foot) at 65% of market rents, while the average market units are $1,502 ($1.76 per square foot), representing a stabilized all-cash yield of 4.2%. The property opened in January 2021 and is currently 98% leased. Killam has a five-year Environmental, Social and Governance ("ESG") goal to increase its affordable housing units by 20% by 2025 from its base of 750 units as at December 31, 2020. This purchase, along with the 78 affordable units acquired with the Nolan Hill property in January 2021, has increased Killam's affordable unit base by 14% (108 units) to date.

Emma Place, Moncton, NB

On October 18, 2021, Killam acquired Emma Place, a new concrete building located at 1321 Mountain Road in Moncton, NB for $31.8 million ($269,500 per unit), representing a stabilized all-cash yield of 3.9%. This 118-unit property has a mix of large one and two bedroom units at an average size of 1,035 square feet, an average monthly rent of $1,402 ($1.35 per square foot) and is currently 91% leased. Building amenities include a fitness room and large social room, along with underground parking. Emma Place is centrally located in Moncton, close to a variety of amenities and well-situated to serve a wide demographic of tenants.

Heritage Valley Central, Edmonton, AB

On October 28, 2021, Killam purchased Heritage Valley Central, a newly constructed wood-frame building located at 11823 22nd Avenue SW in Edmonton, AB for $28.9 million ($235,000 per unit), representing a stabilized all-cash yield of 4.7%. This 123-unit property has a mix of one and two bedroom units at an average monthly rent of $1,507 ($1.79 per square foot) and is currently 90% leased. This property is in close proximity to other Killam assets and is ideally situated to serve the incoming medical professionals that will staff the new Edmonton hospital that is being built nearby.

Nautical Luxury Suites at Summerside, Edmonton, AB

Killam has agreed to acquire Nautical Luxury Suites at Summerside, a 180-unit property that contains three newly constructed wood-frame buildings located at 4203, 4207, and 4211 Savaryn Drive SW in Edmonton, AB for $42.3 million ($235,000 per unit), representing a stabilized all-cash yield of 4.9%. This property has a mix of one and two bedroom units at an average monthly rent of $1,525 ($1.74 per square foot) and is currently 98% leased. Nautical Suites has quality luxurious finishes, underground parking, state-of-the-art mechanical systems and exclusive beach access at the neighbouring lake. This purchase is expected to close during the second week of November.

ESG Commitment Leads to Improved GRESB ESG rating

Killam's commitment to enhance its comprehensive ESG program has earned a green, two-star designation for its 2021 GRESB real estate assessment and realized a 40% score improvement from its initial participation in 2019. Killam also earned a GRESB Public Disclosure survey rating of “A”, outperforming both the global and its GRESB determined comparison group ratings.

The GRESB survey evaluates hundreds of real estate companies worldwide in areas such as management, governance, sustainability, environmental and social programs and policies. The GRESB Public Disclosure survey measures material sustainability disclosures of publicly listed real estate investment companies. Additional details about Killam's ESG efforts and goals can be found in Killam Apartment REIT’s 2020 ESG Report and on its ESG website.

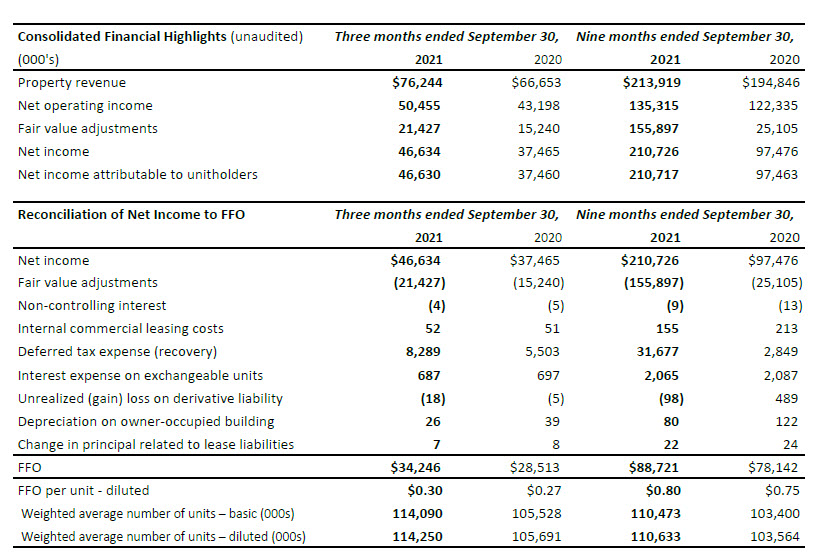

Financial Summary (in thousands, except per unit amounts)

FFO is recognized as an industry-wide standard measure of a real estate entity's operating performance, and Management considers FFO per unit to be a key measure of operating performance. REALPAC, Canada’s senior national industry association for owners and managers of investment real estate, has recommended guidelines for a standard industry calculation of FFO based on IFRS. Killam calculates FFO in accordance with the REALPAC definition. Notwithstanding the foregoing, FFO does not have a standardized meaning under IFRS and therefore may not be comparable to similarly titled measures presented by other publicly traded companies.

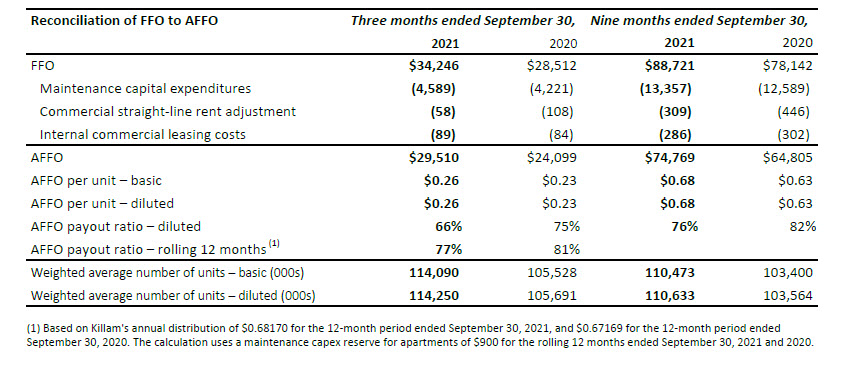

AFFO is a non-IFRS supplemental measure used by real estate analysts and investors to assess FFO after taking into consideration capital invested to maintain the earning capacity of a portfolio. AFFO may not be comparable to similar measures presented by other real estate trusts or companies. Management believes that significant judgment is required to determine the annual capital expenditures ("capex") that relate to maintaining the earning capacity of an asset compared to the capex that generate higher rents or more efficient operations.

Killam uses a rolling three-year historic average of actual maintenance capex for its apartment and MHC portfolios to calculate AFFO. This includes a maintenance capex reserve of $900 per apartment unit, $300 per MHC site and $0.80 per square foot for commercial properties.

Financial Statements

Killam’s condensed consolidated interim Financial Statements and Management’s Discussion and Analysis for the three and nine months ended September 30, 2021, are posted under Financial Reports in the Investor Relations section of Killam’s website at www.killamreit.com and are available on SEDAR at www.sedar.com. Readers are directed to these documents for financial details and a discussion of Killam’s results.

Results Conference Call

Management will host a webcast and conference call to discuss these results and current business initiatives on Thursday, November 4, 2021, at 9:00 AM eastern time. The webcast will be accessible on Killam’s website at the following link http://www.killamreit.com/investor-relations/events-and-presentations. A replay will be available for 7 days after the webcast at the same link.

The dial-in numbers for the conference call are as follows:

North America (toll free): 1-888-664-6392

Overseas or local (Toronto): 1-416-764-8659

Profile

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada’s largest residential landlords, owning, operating and developing a portfolio of apartments and manufactured home communities. Killam’s strategy to enhance value and profitability focuses on three priorities: 1) increasing earnings from existing operations, 2) expanding its portfolio and diversifying geographically through accretive acquisitions, with an emphasis on newer properties, and 3) developing high-quality properties in its core markets.

Non-IFRS Measures

Management believes these non-IFRS financial measures are relevant measures of the ability of the REIT to earn revenue and to evaluate Killam's financial performance. The non-IFRS measures should not be construed as alternatives to net income or cash flow from operating activities determined in accordance with IFRS, as indicators of Killam's performance, or sustainability of Killam's distributions. These measures do not have standardized meanings under IFRS and therefore may not be comparable to similarly titled measures presented by other publicly traded organizations.

- Funds from operations (FFO) is a non-GAAP financial measure of operating performance widely used by the Canadian real estate industry based on the definition set forth by REALPAC. FFO and applicable per unit amounts, are calculated by Killam as net income adjusted for depreciation on an owner-occupied building, fair value gains (losses), interest expense related to exchangeable units, gains (losses) on disposition, deferred tax expense (recovery), unrealized gains (losses) on derivative liability, internal commercial leasing costs, interest expense related to lease liabilities, and non-controlling interest. FFO is calculated in accordance with the REALPAC definition.

- Adjusted funds from operations (AFFO) is a non-GAAP financial measure of operating performance widely used by the Canadian real estate industry based on the definition set forth by REALPAC. AFFO and applicable per unit amounts and payout ratios, are calculated by Killam as FFO less an allowance for maintenance capex (a three-year rolling historical average capital spend to maintain and sustain Killam's properties), commercial leasing costs and straight-line commercial rents. AFFO is calculated in accordance with the REALPAC definition. Management considers AFFO an earnings metric.

- Per unit calculations are calculated using the applicable non-IFRS financial measures noted above, i.e. FFO, AFFO and/or ACFO, divided by the basic or diluted number of units outstanding.

Supplementary Financial Measures

- Same property results in relation to Killam are revenues and property operating expenses for stabilized properties that Killam has owned for equivalent periods in 2021 and 2020. For Killam's commercial portfolio same property NOI is presented on a cash basis, as it excludes straight-line rent. Same property results represent 86.9% of the fair value of Killam's investment property portfolio as at September 30, 2021. Excluded from same property results in 2021 are acquisitions, dispositions and developments completed in 2020 and 2021, non-stabilized commercial properties linked to development projects, and other adjustments to normalize for revenue or expense items that relate to prior periods or are not operational.

- Same property average rent is calculated by taking a weighted average of the total residential rent for the months of the quarter ending divided by the number of the units per region for stabilized properties that Killam has owned for equivalent periods in 2021 and 2020. For total residential rents, rents for occupied units are contracted rent and rents for vacant units are estimated market rent.

- Interest coverage is calculated by dividing adjusted EBITDA by interest expense, less interest expense related to exchangeable units. Earnings before interest, tax, depreciation and amortization (EBITDA) is calculated by Killam as income before fair value adjustments, gains (losses) on disposition, income taxes, interest, depreciation and amortization.

- Debt to total assets is calculated by dividing total interest-bearing debt (net of cash) by total assets, excluding right-of-use assets.

For information, please contact:

Nancy Alexander, CPA, CA

Vice President, Investor Relations & Sustainability

nalexander@killamREIT.com

(902) 442-0374

Note: The Toronto Stock Exchange has neither approved nor disapproved of the information contained herein. Certain statements in this press release may constitute forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate”, "potential", "continue", "remain" ,"forecast" or the negative of these terms or other comparable terminology, and by discussions of strategies that involve risks and uncertainties. Such forward-looking statements may include, among other things, statements regarding: market fundamentals and regional economies in Killam’s markets, demand, construction, development and renovation and the timing thereof, the total investment in development projects and Killam's share thereof, renewals and leasing, return and cost per unit, available units, rental and expense growth expectations, opportunities related to new acquisitions, net operating income growth and annualized FFO expectations, Killam's ability to execute its growth strategy, stabilized all-cash yields from certain properties, benefits as a result of participation in government programs, and demand for certain properties based on proximity to infrastructure and developments.

Readers should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated or implied, or those suggested by any forward-looking statements, including: the effects, duration and government responses to the COVID-19 pandemic and the effectiveness of measures intended to mitigate the impact of COVID-19 and any variants thereof; including vaccines; competition; national and regional economic conditions and the availability of capital to fund further investments in Killam's business. For more exhaustive information on these risks and uncertainties, readers should refer to Killam’s most recently filed annual information form dated March 31, 2021, as well as Killam's most recently filed MD&A, each of which are available at www.sedar.com. Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements contained in this press release.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events may not occur. Although Management believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that future results, levels of activity, performance or achievements will occur as anticipated. Further, a forward-looking statement speaks only as of the date on which such statement is made and should not be relied upon as of any other date. Neither Killam nor any other person assumes responsibility for the accuracy and completeness of any forward-looking statement, and no one has any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, circumstances, or such other factors that affect this information, except as required by law. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The forward-looking statements in this press release are provided for the limited purpose of enabling current and potential investors to evaluate an investment in Killam. Readers are cautioned that such statements may not be appropriate and should not be used for any other purpose.